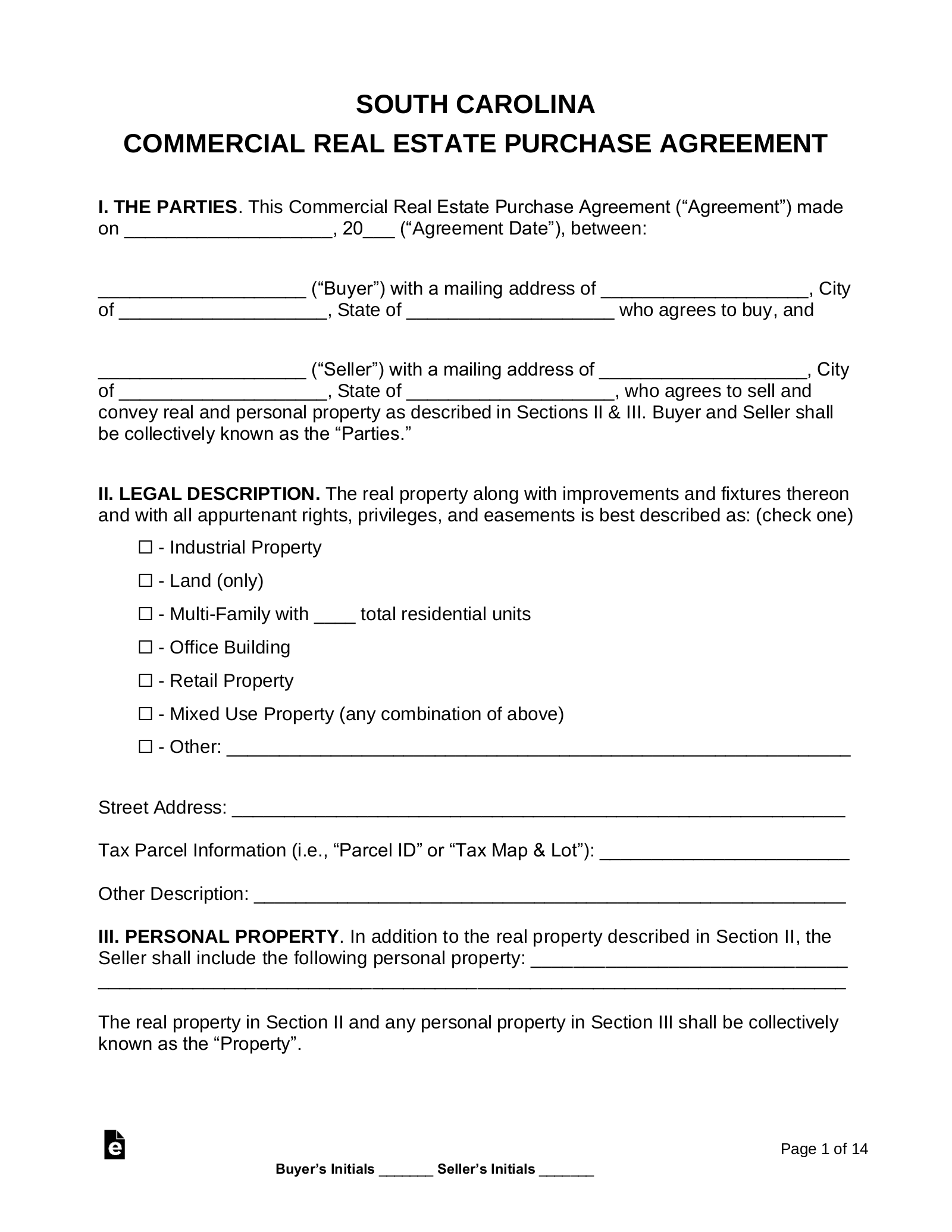

BenefitsDrawbacksActive or Passive Investment REITsPassive financial investment, prevents doubletaxation, potentially greater yields, industrial genuine estate-accessible, high liquidity Taxed as regular income, affected by rate of interest, normally focused in single residential or commercial property typePassive Turnkey Rentals Access to nationwide rental markets, move-in ready, immediate cash-flow, management team deals with everyday operations, tax benefits Greater fees, somebody else handling the property requires high degree of trustPassive House FlippingHigh profit potential, increased market and local market knowledge, fast turnaroundHigh danger, extra or unexpected expenditures, unable to sell, stress, Click here for more potential tax increasesActive Being the Property owner of Your Rental Home Local to the area, easier to have eyes on your residential or commercial property, tax benefitsIlliquid long-term financial investment, you deal with all day-to-day operations and upkeep, actively involved at all times, vacanciesActive Being an active investor indicates you're hands-on with your genuine estate financial investment - what does a real estate agent do.

You might be the one physically putting new tile in a home you're attempting to flip, or you might simply be setting up the specialists to do the work. In either case, you're taking time out of your day to make certain the task gets done. An active real estate financier might also do the legwork of getting occupants into their apartment or condo or scheduling needed repair work.

The more hands-on you are, the greater your returns are most likely to be. The more active you are, the more time it will take out of your day. Being a passive investor means you work with out much of the day to day work. This can be as easy as hiring a property management company to take care of getting occupants and scheduling repairs for you.

Individuals who are already really hectic, or don't desire to worry about all the responsibilities of an active investor, might like the freedom that passive real estate brings. If a pipe bursts at 3 in the morning, the passive investor keeps sleeping, the active real estate financier gets a phone call. how do real estate agents get paid.

The Basic Principles Of How To Get Leads In Real Estate

If you have a lot of spare time, but not a great deal of cash, you might be quite far towards the active real estate investing side. If you are pushed for time but aren't fretted about maximizing your returns, then passive realty investing may be for you. What if you wish to be extremely passive? You don't desire to stress about repairs or discovering occupants.

If that holds true, online realty investing might be best for you. You do not require to buy genuine estate in your regional market. Thanks to the power of the internet, Turnkey business like Roofstock take care of everything for you. They do all the legwork to find you a house with renters currently in it.

It implies they're not going to try to encourage you to acquire a loser residential or commercial property. Going through an all-in-one company like Roofstock is a great investment option for those who don't wish to handle the headache of even discovering a home management company. If this sounds like you, our Roofstock review gets insanely detailed.

Acquiring REITs has to do with as passive as you can get and still technically remain in the genuine estate game. A Real Estate Investment Trust (REIT) owns countless investment residential or commercial properties. By acquiring a REIT, you're investing in the company, not an individual structure. Purchasing REITs resembles purchasing shared funds in the stock market.

The 8-Second Trick For How To Start Investing In Real Estate With Little Money

It's a dividend-paying investment with the legal requirement to disperse at least 90% of its taxable income back to the shareholders. You can, T. Rowe Rate, Fidelity, or any place you invest. Most business have a minimum investment amount of a couple of thousand dollars, but after that, you can acquire partial shares.

The returns probably won't be as substantial as with other property investments, however it's likewise less dangerous given that one poor deal won't sink the entire ship. Diversify into income-producing genuine estate without the dramatics of real occupants. Presently, their return is that of the Lead REIT Index Fund. Mentioning sinking the entire ship, how risk-tolerant do you desire to be? Are you looking for a safe course to gain a constant rate of return or would you rather risk a larger loss in hopes of a considerable gain? For people who want to decrease their threat investing in REITs is the best option.

There are obvious dangers with each type of property investment. You might purchase a duplex only to discover no one wishes to lease it from you. You might buy a piece of land in hopes the value increases, but instead, it decreases. Investors who lend money to property developers take the risk that the designer will lose their money or the market will turn, and nobody will buy the completed product.

Each kind of investor takes on a different amount. Having a genuine estate representative you can rely on is necessary to assisting you feel comfy investing your cash. Whether you want a rental home to generate money flow, or merely want to purchase and hold, If you want greater returns than REITs provide, or you don't want to pay a company like Roofstock to do all the work for you, then you'll require to discover an excellent property agent.

What Does What Does Mls Stand For In Real Estate Mean?

They likewise have the experience to understand the difference between an excellent investment and a bad one. It's one way to considerably decrease your danger of winding up in a bad deal. As soon as you get comfortable in the world of genuine estate, You can end up being a realty agent for just a couple of thousand dollars and a couple months of study.

It's https://602ea4aee8537.site123.me/#section-606ed55e1bb82 not unusual for this side hustle to develop into a full-on property career. Being a realty agent is a lot more work than merely buying real estate, but it can fill in your regular job. How much you can earn as a property agent depends upon a few elements consisting of: Your regional genuine estate market How difficult you struck the streets and get your organization card in enough prospective hands How good you are at communicating with timeshare compliance reviews your customers.

It's only one outstanding method you can optimize your profits. A refers to someone who belongs to the National Association of Realtors. A is someone who is certified to assist you purchase or sell industrial or house. Not everyone who is a real estate agent is technically a genuine estate agent.

Before you buy, you wish to you're looking at. There are several things to consider: Find out what the home taxes are If you're working with other investors, inspect to see if they're certified If you're getting a loan through the bank, ensure your home mortgage payment and rates of interest aren't going to bury you if you have jobs Inspect to see if you can reasonably (when the monthly rent earnings equivalent 1% or greater of the purchase price) Speak to your CPA about potential tax benefits for the various kinds of property financial investments If you're planning on doing a lot of the work yourself, these are simply a few of the questions you'll need to ask prior to you make a purchase.